Corruption is at the heart of the endemic franchise fraud in the United States.

The most effective solution against corruption I know is using leaks of documents that prove the fraud and are picked up by media. Until franchisees take this measure, little else is likely to work. The endemic fraud wouldn’t exist unless people were making money off of it — and a lot of money. Those who make money are to likely to allow the corruption to end until they are exposed. That’s the way corruption works.

Three factors that together indicate corruption in the United States’ franchise industry:

1. The Federal Trade Commission falsely appears to regulate the industry, giving potential new franchisees false confidence that they will be protected when they purchase a franchise.

In the United States, the Federal Trade Commission has a Franchise Rule it doesn’t enforce. I’ve heard through the grapevine that the FTC hasn’t taken action on a report of franchise fraud in decades. If you have any information proving otherwise, please text me or contact me on LinkedIn.

Potential new United States’ franchisees — people who are considering making a franchise purchase — have good reason to assume the industry is safe. The Franchise Rule makes it falsely appear that the industry is a sound investment when in actuality it is not.

The FTC requires franchisors to provide potential new franchisees a long and very formal document called a Franchise Disclosure Document or FDD. The FDD is highly structured following a format designated by the FTC.

Of course potential franchisees assume that this highly formal document means there is a high level of government regulation. Of course they assume that a high level of government regulation means the United States franchise industry is a safe investment.

Again, investing in franchising in the United States is anything but safe. The numbers tell the truth.

2. The Federal Trade Commission doesn’t enforce its own Franchise Rule

According to Keith Miller of Franchisee Advocacy Consulting, “The FTC only has one person enforcing the Franchise Rule. His time is split with regulating funeral home businesses.” And, according to Miller, this half a person who’s enforcing the rule works only on “regulating the pre-sale portion of this huge industry.”

That means that the FTC is doing NOTHING to police any violations of the Franchise Rule. It has a whole slew of pre-purchase disclosure requirements — not necessarily the right ones, but a whole slew nonetheless. Yet there is no public punishment after franchiSORS lie in their FDDS.

That’s like having a government that posts speed limit signs to give off the impression that cars will drive safely, but that doesn’t have highway troopers to enforce the limits.

EXAMPLES OF COMMON FDD LIES:

3. The FTC has resisted allowing for private enforcement of the Franchise Rule

In 2007, the FTC revised the Franchise Rule without adding measures that would allow for private enforcement.

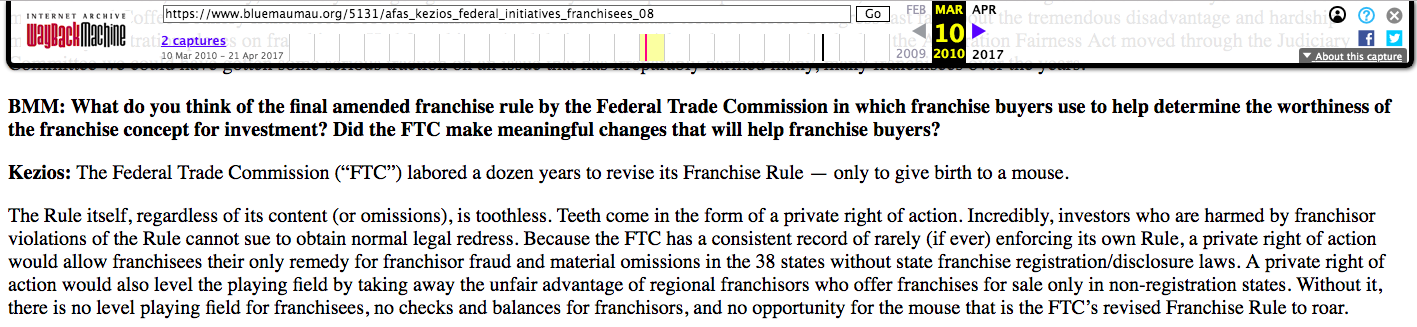

According to the Coalition of Franchisee Associations, “Susan Kezios, chairperson of the American Franchisee Association, told Blue MauMau just how little change there was for franchisees. ‘The Federal Trade Commission labored a dozen years to revise its Franchise Rule — only to give birth to a mouse,’ declared Kezios.”

Evidently the Blue MauMau article that originally quoted Kezios has been removed from the Internet.

Fortunately, WayBack Machine captured a screenshot of the removed the page and we can still see what was said before it was censored.

Together, these three things indicate corruption:

What all this means is that FTC has a rule 1) that appears to be strict and regulated, 2) that it doesn’t enforce and 3) that it doesn’t make possible for franchisees to privately enforce.

Together, 1-3 above, indicate corruption.

What good would speed limits be if we had no troopers to enforce them? Do you think we could really trust all drivers to “self-regulate” and follow the posted speed limit signs in order to prevent car accidents and protect the better good of society?

It would be better to have no rule at all than to have a rule without teeth.

But what if there were a rule and somebody was invested in the rule not being enforced? Wouldn’t that be corruption? Who would be paying whom to make sure that the rule existed and made it appear to future franchisees that investment was safe when in actuality it was not?

And there’s more:

The International Franchise Association (IFA) began lobbying against Senator Cortez Masto’s new SBA Franchise Loan Transparency Act before she introduced it on July 31st. The IFA makes its money off of franchise sales. No doubt, the IFA also lobbied against the Fair Franchise Act of 2017.

Clearly, the people who make money like the status quo and the people who lose money want change. The franchiSORS are making money, have almost all the power, and are lobbying to maintain the status quo. The franchiSEES are losing money and are building a coalition to expose the fraud.

If you’re thinking of buying a franchise, don’t.

If you’re thinking of becoming a franchiSOR, here’s a guide on how to commit fraud and make a lot of money. You might want to think twice about getting involved in the corruption at this point, though. Maybe the franchiSORS will actually be held accountable.

The way to fight corruption is exposure and use of media. At this point, franchiSEES need to leak evidence in a way that entices the press. Without media, corruption will continue and the next iteration of the Franchise Rule will be no safer for franchiSEE investors than the last.