Senator Cortez Masto’s proposed SBA Transparency Act of 2019 is necessary because of the long history of fraud in franchising. Her one-pager begins with a list of franchise owner associations that support the bill and are ready to publicly fight against the endemic fraud. The list includes household names like 7-11, Subway and Dunkin Donuts.

Franchisees who have purchased 7-lls, Subway Sandwiches, Dunkin’ Donuts, Little Caesars, Kumon, Meinke and more are standing together in support of the small step towards transparency the Senator’s bill would offer.

And what’s more… associations of owners’ associations are supportive of the bill: the Coalition of Franchisee Associations and the American Association of Franchisees and Dealers.

This is significant. Not only are franchisee owners associating with other franchise owners in their own franchise systems, the franchise owners’ associations are banding together so that they have more strength to overcome their opposition.

But who, exactly, is their opposition?

Well…. the answer to that question is, unfortunately, the International Franchise Association (IFA). According to the IFA’s website, they are the “Top Resource for Franchise Opportunities Worldwide.” Website visitors are offered the opportunity to “explore franchising opportunities that match your goals, resources and passions.” And the IFA claims that “as the world’s largest franchising association, [the] IFA is in the position to set you and your business up for lasting success.”

A “franchisING association” like the IFA is different than a “franshisEE association.” If you’re a concerned taxpayer worried about the next large-scale banking scheme that causes people to lose their homes, it’s important to know that in the franchise world, there are two classes of people: franchiSORS and franchiSEES.

The franchiSORS own the franchised businesses and the franchiSEES buy the rights to run them. Subway headquarters (the franchiSOR) is in Milton, Connecticut, and they have franchised locations around the world run by franchiSEES. The local owners you meet when you buy a sandwich (or a pizza, or a cup of coffee) are on the franchiSEE side of this conflict.

An “owners’ association,” like the Subway, Dunkin’ Donuts, and Little Caesars’ associations you see that are all in support of the bill, are associations of franchisEES… of the owners of the local shops.

The owners of the local shops are taking on their respective corporate headquarters and they’re using congress to do it.

And the IFA is an association of, well…. it’s an association of the people who make money selling franchises. After all, there are over 1400 options available if you visit franchise.org.

The IFA wants to keep making money selling franchises. And… it doesn’t want The SBA Transparency ACT of 2019. It doesn’t want to have to disclose revenue to potential franchisee investors in order for franchiSEE buyers to have access to SBA taxpayer backed loans.

Why not? (Think really hard…. er…. $$$$…. that was tough)

But it’s obvious that the government shouldn’t be backing loans without the franchiSEE investors themselves having the opportunity to understand earnings! The IFA’s lobbying is self-incriminating.

And how can the IFA really be invested in setting new franchisEES up for “lasting success” as they claim on their website, if they’re not even supportive of new franchisees having access to actual numbers before they sign franchise agreements with personal guarantees and take out large SBA loans?

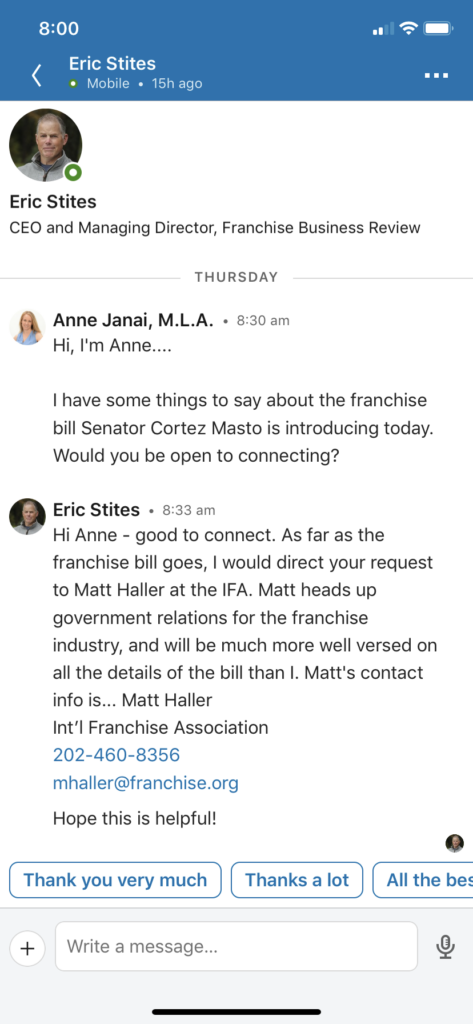

And, most alarmingly, although not at all coincidentally, the IFA is, as Eric Stites, CEO and managing director of the Franchise Business Review told me on August 1st, 2019, the organization that “heads up government relations for the franchise industry.”

In other words, the organization that is in charge of government relations is an organization that is making money off of the sale of franchise locations. And when associations of franchisEES finally band together to try to get transparent lending practices (a lot of people have been burned), the IFA lobbies against them!

It sounds to me like somebody new ought to start heading up government relations for the franchise industry.

SBA loans are backed by taxpayers. Hmmmm….. which financial crisis is this reminiscent of?