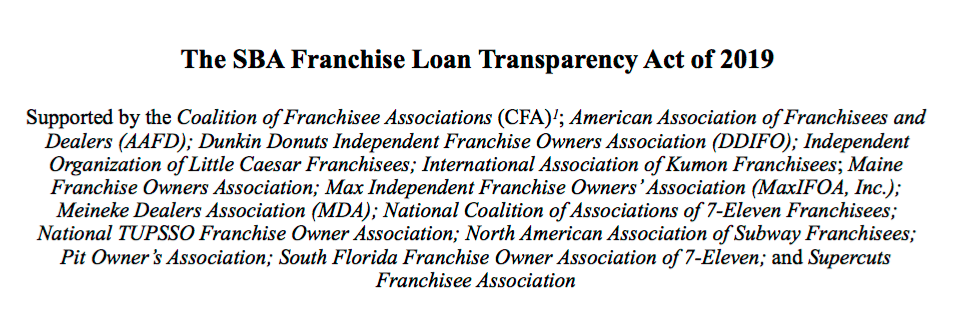

Below is the “one-pager” of the SBA Franchise Loan Transparency Act as it was provided to me (pdf) on July 31, 2019. The bill (S.2383) will be posted to www.congress.gov at some point in the near future.

[UPDATE: The full and official text of the bill can be now found here (pdf).]

The SBA Franchise Loan Transparency Act would bring about transparency in the Small Business Administration guaranteed loan process and ensure that the franchisee borrower, the lender, and the SBA would all have access to revenue and store closing data needed to make informed business decisions.

Background

Franchise businesses represent a large segment of retail and service businesses and are rapidly replacing more traditional forms of small business ownership in the American economy (2). One of the benefits of franchising is the presence of accurate revenue, profit and loss, and other financial data that can guide an entrepreneur deciding to buy a franchise business.

Many potential franchisees rely on SBA guaranteed lending programs to access credit to buy a franchise. One of the key components of the SBA guaranteed loan process is the franchise disclosure document (FDD) prepared and presented by the franchise corporation (franchisors) for the franchise owner (franchisee). Unfortunately, franchisors are not required to disclose any financial performance projections or estimates about franchised businesses, such as first-year revenue estimates, which are used as a guide when determining the loan type, amount, and payment schedule. As a result, according to a 2013 Government Accountability Office (GAO) study (3), this information is often left out of the FDD by franchisors. Furthermore, a 2011 audit (4) conducted by the SBA Office of the Inspector General found that when franchisors did include first-year revenue projections, they were significantly higher than historical actuals. Without accurate financial disclosure, franchisees with SBA loans, especially veteran-owned businesses, are more likely to fail; because they are guaranteed loans, lenders and borrowers — and sometimes taxpayers — cover the loss (5).

Although franchisors are not required to share financial performance projections or estimates with prospective franchisees, they often must share it with franchise lenders in order to have the loans approved. This means that entrepreneurs are kept in the dark about crucial financial performance information about the business they are investing in, even though this same information is compiled and distributed to their lenders (6). As the author of a law review article put it, “[o]ne of the ironies regarding FPRs [financial performance representations] is that even those franchisors that do not make FPR claims in their FDD must often create and distribute those exact same numbers to the financial institutions of prospective franchisees seeking financing to purchase the franchise” (7).

In 2012, the SBA released stunningly high levels of failure rates of small business loans sorted by franchise brands from October 1, 2001 until September 30, 2011 (8). A 2015 independent study similarly found that the failure rate on SBA-backed loans to franchisees is high and rising,reaching nearly one in five in the most recent period (9). Since then, the SBA has stopped releasing franchise loan default rates by brands; however, a recent letter finds some brands reaching high loan default rates (10).

The bill requires any taxpayer-backed SBA loan to a franchise to provide:

(a) The average and median first-year revenue for all franchise businesses for each of the preceding three years, in accordance with the 2017 North American Securities Administrators Association (NASAA) Franchise Commentary on Financial Performance Representation and

(b) The number of franchise locations that went out of business or were sold by the franchisee during the first year of operation for each of the preceding three years.

(c) The franchisor shall not disclose any revenue numbers, directly or through a third party, that conflict with the revenue numbers provided in the disclosure document, unless the franchise purchase includes existing units, in which case the actual revenue numbers shall be disclosed for those units.

This historic revenue disclosure is necessary to prevent failure and fraud in the SBA guaranteed loan process and to ensure a fair and solid start for small business owners. This language removes hidden discussions between the franchisor and the lender regarding financial data critical to the SBA guaranteed loan process. It also lowers SBA borrowers’ default rates which would result in lower fees and rates and possibly prevent taxpayers from compensating the lenders for failed loans. This bill protects franchisees and the SBA itself by increasing the likelihood that these small businesses will succeed.

1 Coalition of Franchisee Associations. “Support the Franchise Loan Disclosure Act.” Coalition of Franchisee Associations. January 12, 2017. http://thecfainc.com/action-center/.

2 International Franchise Association. “National Impact of Franchising.” International Franchise Association. 2019. https://franchiseeconomy.com/.

3 United States Government Accountability Office. Small Business Administration Review of 7(a) Guaranteed Loans to Select Franchisees. September 2013. https://www.gao.gov/assets/660/657723.pdf.

4 Office of Inspector General U.S. Small Business Administration. Report Number: 11-16. July 13, 2011. https://www.sba.gov/sites/default/files/oig/Audit Report 11-16_0.pdf.

5 Taylor, Kate. “Report: 10 Brands Most Likely to Have Franchisees Default on Their Loans.” Entrepreneur. September 11, 2014. https://www.entrepreneur.com/article/237376.

Clark, Patricia. “Franchise Loans Keep Blowing Up, and the Government Keeps Backing Them.” Bloomberg. May 14, 2015. https://www.bloomberg.com/news/articles/2015-05-14/franchise-loans-keep-blowing-up-and-the-

government-keeps-backing-them.

6 Ellison, Keith. “Special Investigation: Franchising,” in We The Podcast. August 4, 2015. https://www.podomatic.com/podcasts/wethepodcast.

7 Rooks, Marvin. “It’s Time for the Federal Trade Commission to Require Financial Performance Representations to Prospective Franchisees.” Wake Forest Journal of Business and Intellectual Property Law. 2010-2011. http://ipjournal.law.wfu.edu/files/2011/02/article.11.55.pdf.

8 Mack, Jonathan. “SBA Enables Franchise Liar Loans: Chronically Fails to Act on its Own Recommendations.”Blue Mau Mau. October 15, 2013. https://www.bluemaumau.org/blog/2013/10/15/sba-enables-franchise-liar-loans-chronically-fails-act-own-recommendations.

9 Patton, L. “U.S. Franchise Owners Say They Can't Make a Decent Living.” April 30, 2015. Bloomberg. https://www.bloomberg.com/news/articles/2015-04-30/u-s-franchisees-say-they-can-t-earn-decent-living-survey-

says.

U.S. Government Accountability Office. Patriot Express: SBA Should Evaluate the Program and Enhance Eligibility Controls. September 12, 2013. https://www.gao.gov/products/GAO-13-727.

10 Seaborn, Dianna L. “SBA response to Senator Catherine Cortez Masto.” June 17, 2019.